[ad_1]

Reliance Q4 Results Today: Reliance Industries, the conglomerate spanning oil, telecom, and chemicals, is set to unveil its financial performance for the quarter ending March 31, 2024, on April 22, 2024 (Monday).

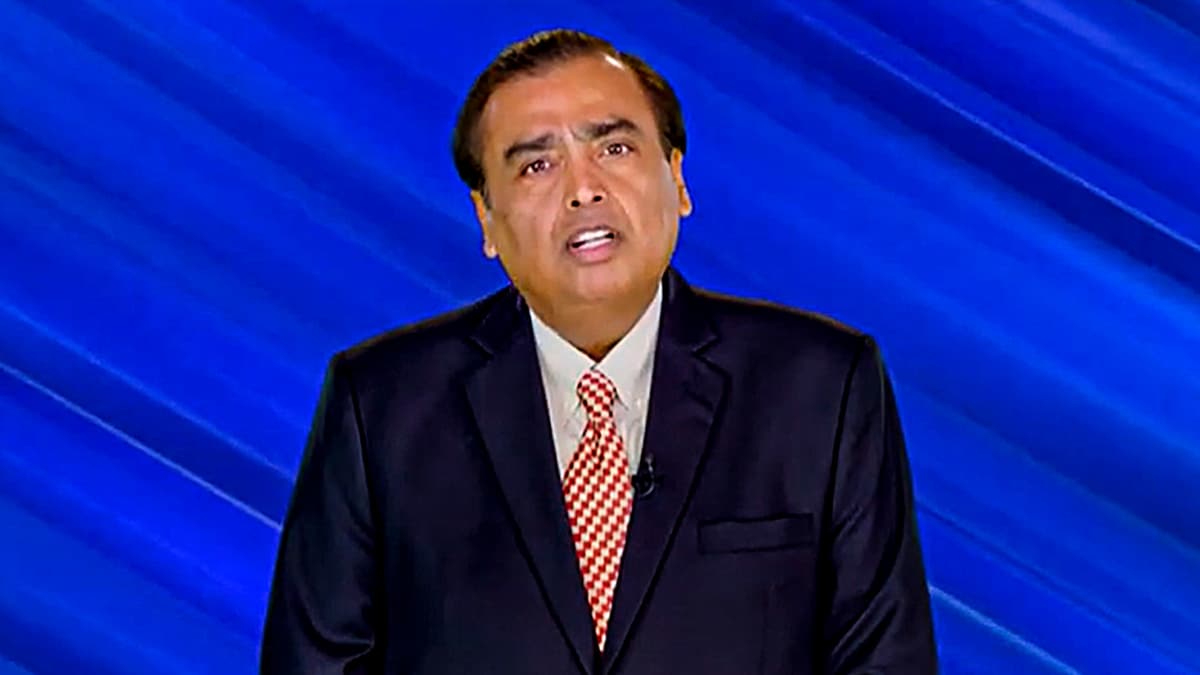

In a regulatory filing on April 15, billionaire Mukesh Ambani-led company said, “a meeting of the Board of Directors of the Company is scheduled to be held on Monday, April 22, 2024, inter alia, to: consider and approve the standalone and consolidated audited financial results of the company for the quarter and year ended March 31, 2024; and to recommend dividend on equity shares of the Company for the financial year ended March 31, 2024.”

RIL Q4 Results Expectations:

Analysts anticipate that an uptick in refining margins and a resurgence in the petrochemicals cycle will drive Reliance Industries’ earnings growth for the fourth quarter of fiscal year 2024.

According to a survey of 10 analysts conducted by Moneycontrol, the average expectation is for consolidated revenue to rise by 11.4 percent year-on-year to Rs 2.12 lakh crore.

Analysts forecast that the conglomerate’s earnings before interest, taxes, depreciation, and amortization (EBITDA) will climb by 9.4 percent to Rs 38,440 crore, driven by strong performance in the O2C sector. While sustained growth in Jio and retail is expected, this will be partially offset by a downturn in the upstream segment.

JP Morgan analysts note that Reliance gains from the surge in crude prices, leveraging its oil production from fields along the nation’s eastern coast, among other avenues.

“A continued upward bias to oil should drive outperformance for RIL over the rest of the market and other Indian energy stocks,” the brokerage said.

Net profit for the quarter, however, is expected to drop 5.7 percent to Rs 19,299 crore on increased depreciation and high tax rate, according to the survey of brokerage estimates, Moneycontrol reported.

Reliance is likely to see a sharp jump in its O2C segment sequential earnings on improved gross refining margins (GRM), better petrochemical spreads and higher refining throughput.

According to JM Financial, RIL’s O2C EBITDA may rise 11.8 percent sequentially to Rs 15,700 crore even though petchem margin is still expected to remain subdued during the fourth quarter.

Reliance Q4 Results 2024 Date and Time: Reliance Industries will declare the results of the fourth quarter of financial year 2023-24 (Q4 FY24) today (April 22). The announcement is expected to occur post-market close.

RIL Q3 Results

During the October-December 2023 quarter, Reliance Industries recorded a 10.9 percent increase in consolidated profit after tax (PAT) to Rs 19,641 crore. In comparison, the profit after tax for the same quarter in 2022 stood at Rs 17,706 crore.

In the first three quarters of the fiscal year 2023-24 (April-December), the company’s profit after tax increased from Rs 52,443 crore to Rs 57,777 crore. As for consolidated revenue, Reliance Industries saw a 3.2 percent uptick to Rs 248,160 crore, driven by sustained growth in consumer businesses. Comparatively, revenues for the same quarter in the previous fiscal year amounted to Rs 240,532 crore.

For the quarter ending in December 2023, Capital Expenditure amounted to Rs 30,102 crore. This investment was directed towards the nationwide rollout of 5G, the expansion of retail infrastructure, and the development of new energy ventures. It’s important to note that this figure excludes expenses related to spectrum, and it’s adjusted for capital advances and asset regrouping.

Shares of RIL on April 22 were trading at 2,942 at around 9.40 am on the BSE.

Disclaimer: News18.com is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

[ad_2]

Source link